EU VAT control and document preview.

Check what’s new in eFaktura.nl!

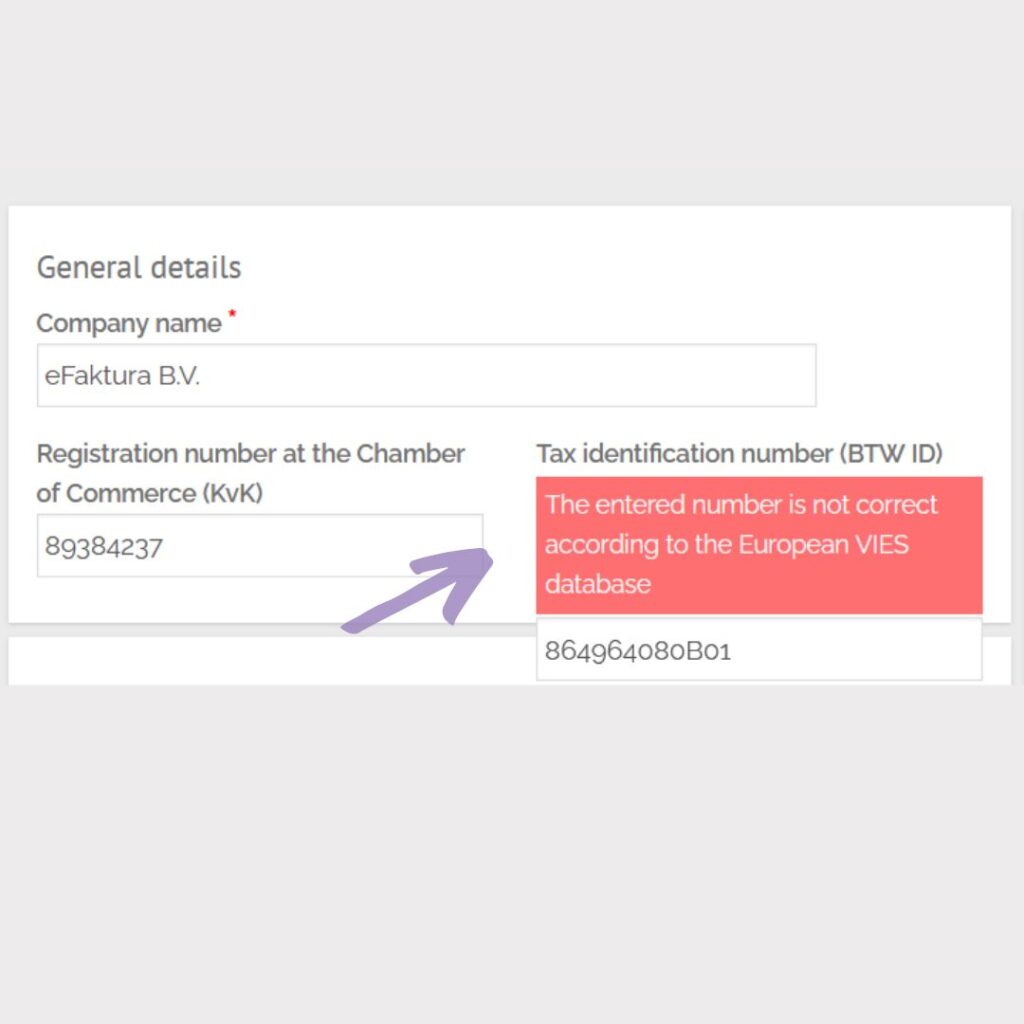

EU VAT control in the VIES search engine.

We have connected eFaktura.nl with the European VAT number search engine – VIES.

From now on, you can check directly in eFaktura.nl whether your contractor has an active EU VAT to apply the 0% VAT rate for European transactions, or make an invoice with reverse-charged VAT.

What is EU VAT needed for?

EU VAT and foreign transactions.

Every entrepreneur who wants to perform transactions with foreign contractors from the European Union should register for EU VAT.

EU VAT, and the amount of the VAT rate on the invoice.

The status of the entrepreneur in the VIES search engine determines the application of the VAT rate (Netherlands. BTW) for a European transaction (0%). This means that EU VAT payer status affects the final amount on the invoice.

VAT verification for reverse charge transactions.

In the Netherlands, verification of the customer’s VAT number is also important for reverse-charged VAT invoices. This applies, for example, to construction and cleaning companies.

What does the EU VAT number look like?

The EU VAT number is your BTW number prefixed with the country where you are based.

For example:

1. Dutch EU VAT number: NL123456789B01

2. EU VAT number from Poland: PL1234567890

3. EU VAT number from Germany: DE123456789

4. EU VAT number from Belgium: BE1234567890

How does EU VAT verification work?

The VAT status is verified automatically when adding a new one or editing customer data.

The system will inform you if you have typo or wrong number or your contractor does not have an active EU VAT status.

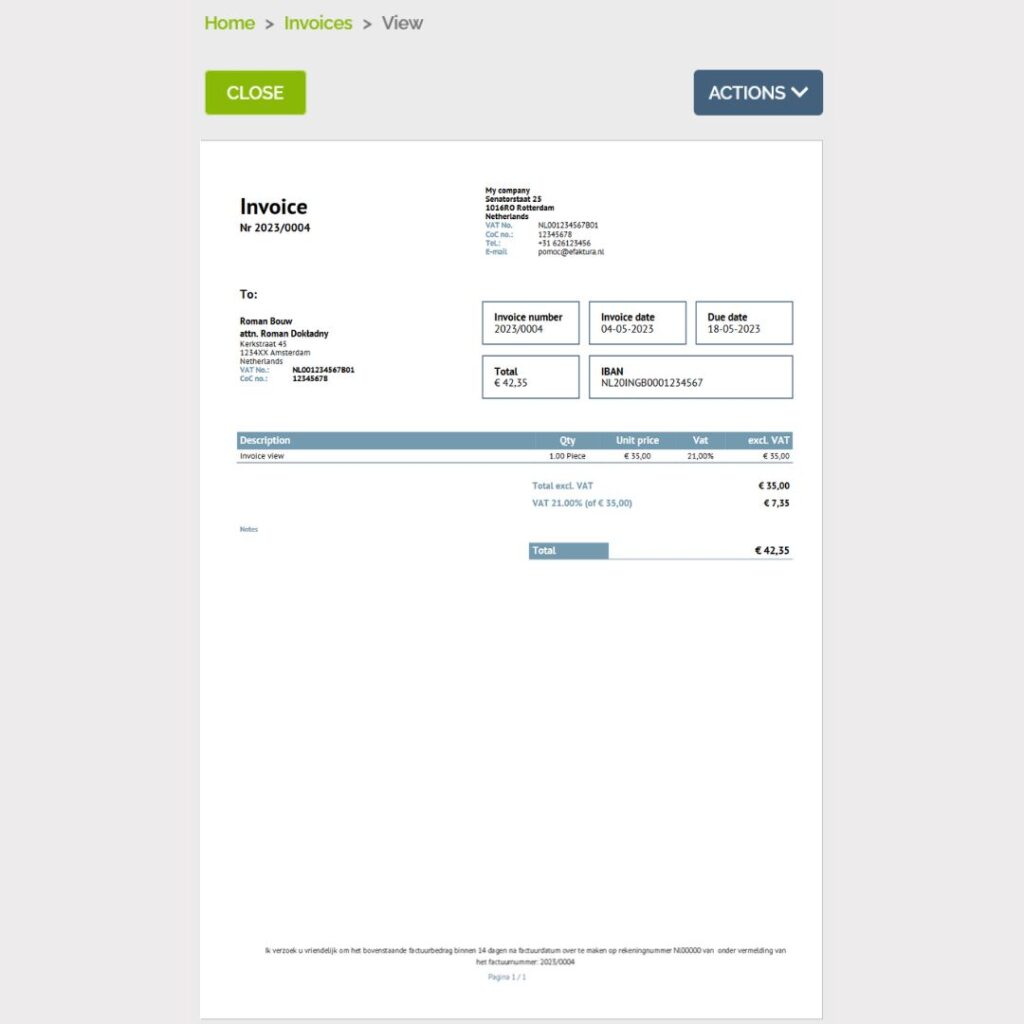

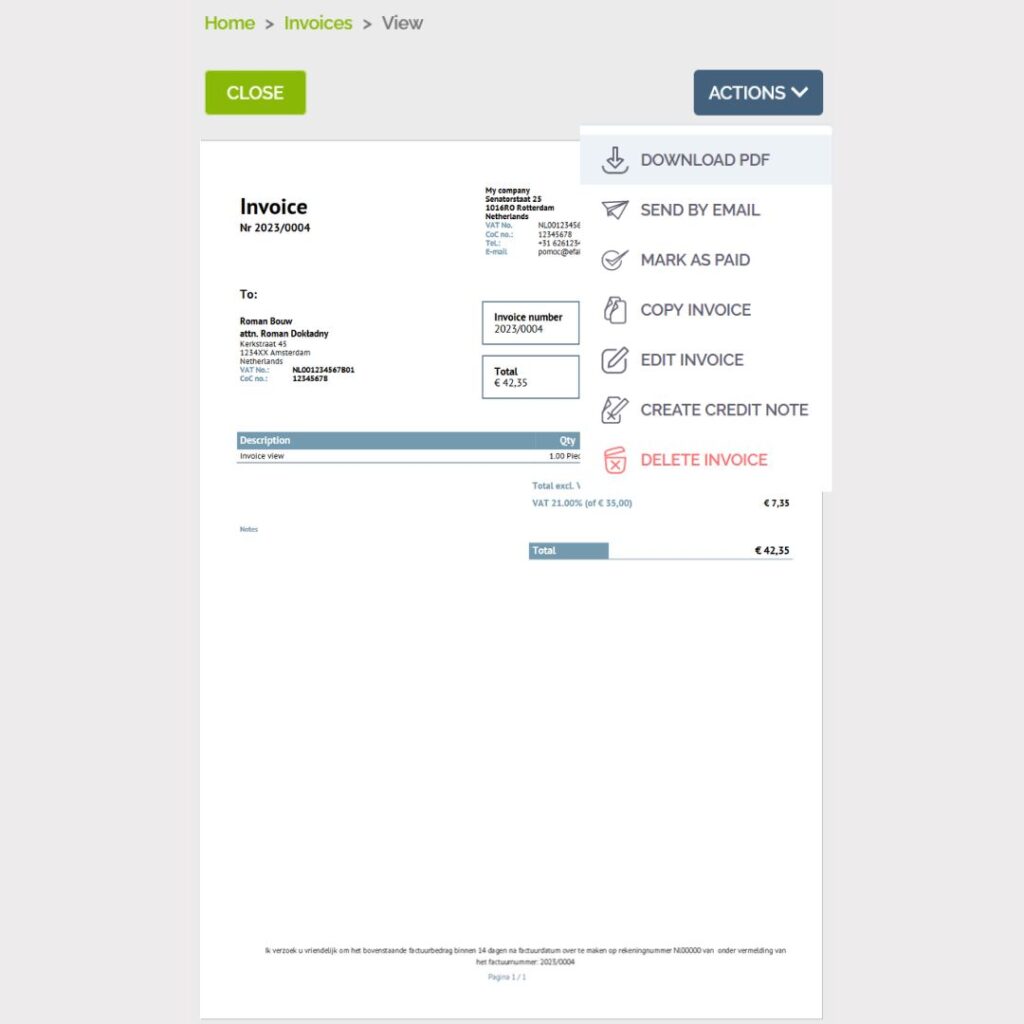

Preview of the offer and invoice.

It’s a small thing, but it’s fun!

From now on, when adding or editing an invoice/offer, you will see the preview of the document you’ve created.

Preview of the invoice and offer is an additional opportunity to check whether your data is correct.