Issuing invoices is the most enjoyable part of running a business!

Invoice on the go

Issue and send invoices the way you like – from the mobile app or your computer browser.

Invoice in your own language

Use the application in your language, and the AI assistant will translate everything for you.

Invoices for everyone

An ideal system for ZZP with and without VAT, as well as for companies.

SIMPLE AND ACCURATE

Issue invoices in the Netherlands, Belgium, and Germany

Currency converter, virtual assistant eFakturAI, database,

e-invoice format – all in one application.

Entrepreneurship without language barriers

Language is no obstacle to the growth of your business when you use eFaktura.nl.

We make running a business abroad easier

The application is always up to date with the tax requirements of the country you operate in.

The beginning is always today

Start invoicing

in any moment of the year.

Set the number and continue invoicing.

Perfect Invoices!

There is no need to worry about the fiscal standards of the country, where you run your business. We will take care of it.

The beginning is always today

Start invoicing

in any moment of the year.

Set the number and continue invoicing.

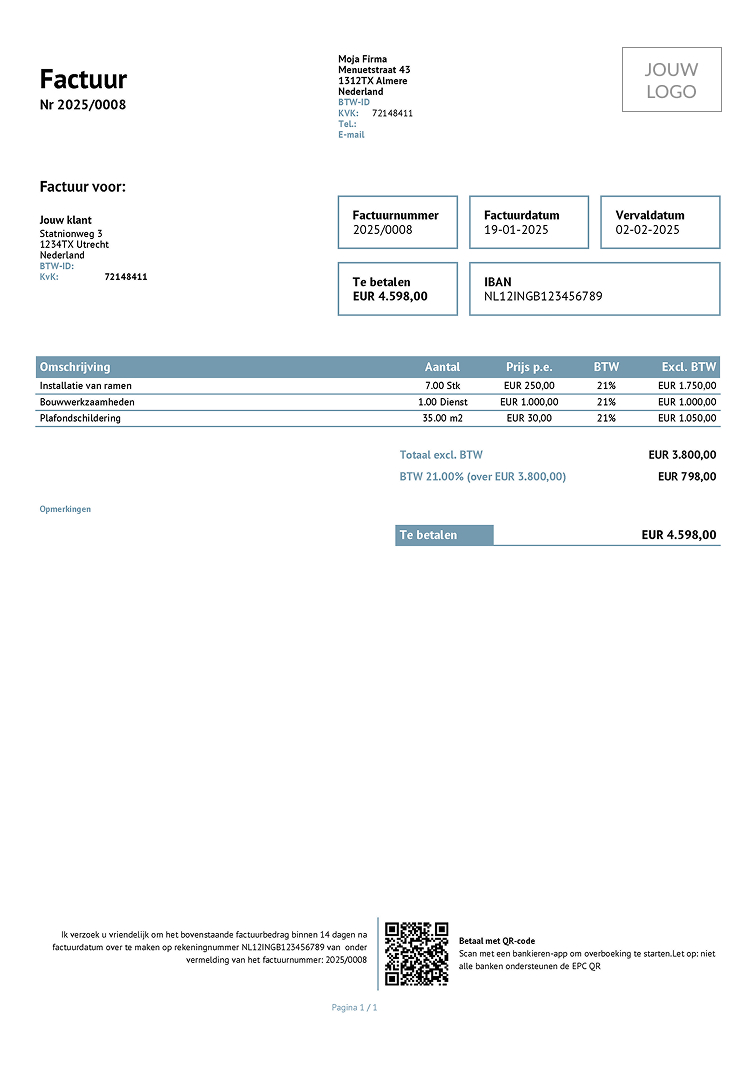

Stand out

Do you know that a professional invoice is a vital element of your company’s image?

We have a spot for your logo!

Your invoices get paid conveniently

EPC QR code speeds up payments.

Stand out

Do you know that a professional invoice is a vital element of your company’s image?

We have a spot for your logo!

Your invoices get paid conveniently

EPC QR code speeds up payments.

You are in control

With eFaktura.nl, you will take control of your company’s administration and enjoy independence!

Invoice whenever you want, with the right VAT rates and reverse VAT. Correct invoices, issue similar ones, and send them directly from the app. Here, everything is up to you!

Feel secure

The eFaktura.nl system meets the highest standards of data storage security.

We will store your documents for the next 10 years because data security is our priority.

AN APP AS FLEXIBLE AS YOU

Invoices for A1 companies

You can freely do business in the Netherlands, Belgium, or Germany while having a registered company in another country.

With A1, issue invoices according to applicable regulations, in the client’s language.

Give your accountant access to invoices

In the application settings, send an invitation to your accountant to use the eFaktura.nl Accountant panel.

Your accountant will have continuous access to invoices and costs, saving you from the additional task of providing full documentation for settlements.

FAQ

– 21% – standard.

– 9% – reduced (food, books, medicines).

– 0% – exports and intra-EU supplies.

– 21% – standard.

– 12% – intermediate (social housing, gastronomy).

– 6% – reduced (food, books, renovations).

– 0% – exports and intra-EU supplies.

– 19% – standard.

– 7% – reduced (food, books, culture).

Invoices in eFaktura.nl can be issued in Dutch, English, German, Polish or French.

You can start using the invoicing app at any time of the year. Just keep in mind that invoice numbering must be continuous. You can set your first invoice number manually in the settings.

Yes, eFaktura.nl works on computers and mobile devices (as an app and in a web browser). No matter what device you choose, your account data will always be synchronized.

– PDF – common format for sharing

– XLS – format for spreadsheets

– XML – standardized UBL (universal business language) electronic invoice format for automatic processing.

An invoice saved in XML format that meets the EN 16931 standard for electronic invoices, enabling integration with the European Peppol system

You can download the necessary documents and send them to the accounting office or use automation by granting your accountant ongoing access to documents. In that case, the accountant will download invoices for settlements independently. In the application settings, enter the accountant’s email address and send an invitation.

A reverse charge invoice transfers the VAT settlement obligation to the buyer, so the seller issues an invoice without VAT. It is mainly used in B2B transactions within the EU or for specific goods and services.

You can check out all the cool features

by signing up for a 30 day

free trial period.

After the trial period just choose the package that best suits your company.

Any doubts?