Reverse VAT in the Dutch Construction Industry

In the Dutch construction industry, a special tax mechanism called reverse VAT (BTW verlegd) applies to prevent fraud and simplify tax administration in transactions between businesses.

Who pays the VAT?

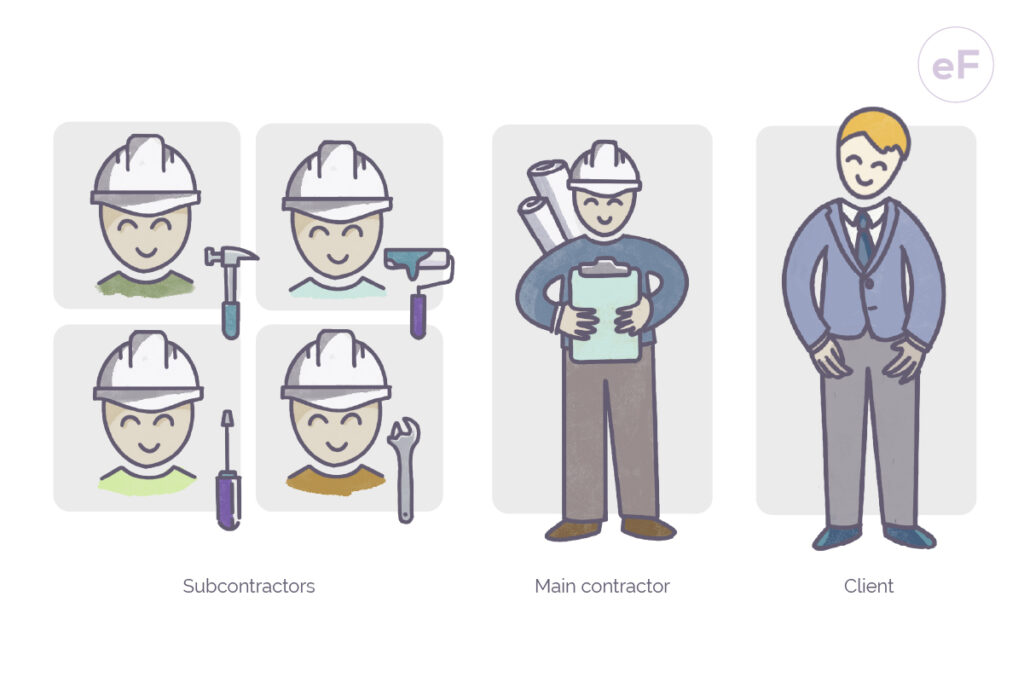

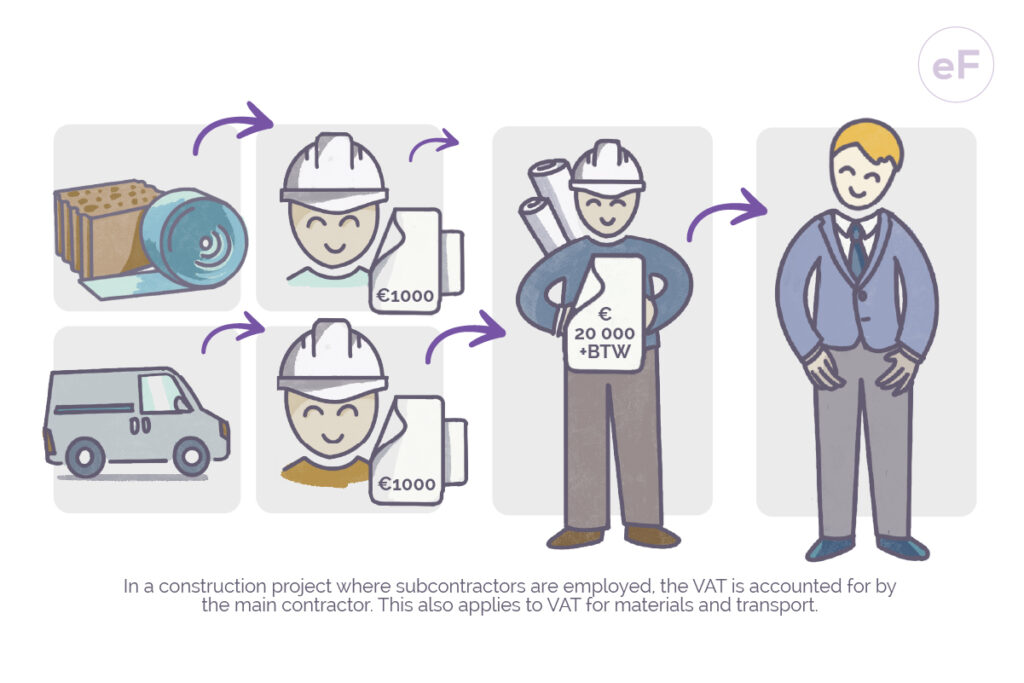

In the Dutch construction industry, the main contractor of the project is responsible for paying the VAT. For instance, if you are responsible for carpentry on a construction site, the entire VAT for the project will be paid by one entity – the main contractor.

Key Terms:

BTW Verlegd – Reverse VAT

Hoofdaannemer – Main contractor

Onderaannemer – Subcontractor

It is crucial to distinguish whether you are acting as a main contractor or a subcontractor. The main contractor directly collaborates with the final client and is responsible for the entire project. Subcontractors, on the other hand, perform specific tasks commissioned by the main contractor.

Want to better understand business customs in the Netherlands? Read HERE.

How does BTW Verlegd work?

As a subcontractor, you issue an invoice without charging VAT but indicate that the VAT is transferred to the main contractor.

Make sure to include the client’s VAT ID number on the invoice, similar to the Polish NIP number. An example VAT-ID number is NL000099998B57 (country code NL, 9 digits, letters B and 2 check digits).

eFaktura.nl integrates with the European VIES VAT number register, providing automatic verification of the VAT-ID number’s validity.

In practice, this means that the subcontractor does not remit VAT for the service provided, while the main contractor must report the VAT in their return.

If you use the reverse charge mechanism, you remain responsible for ensuring the VAT from the transaction reaches the tax office. Therefore, it is advisable to verify in advance that the company to which you transfer the VAT obligation qualifies for it, i.e., is an active VAT payer. You can check this in the European VIES database.

Learn how the VIES database works in eFaktura.nl HERE.

When to Use BTW Verlegd?

This mechanism is mainly used for construction and renovation services where transactions occur between various companies within the country. It is particularly relevant when the work is carried out as part of larger projects and requires coordination between many entities.

You should also use BTW verlegd in the case of international transactions. When your Dutch company uses the services of a foreign company, the obligation to pay VAT falls on you.

In summary, the BTW verlegd mechanism depends on the nature of the transaction. If you are unsure which invoice to issue to your contractor, it is best to consult an accounting office. Remember that by using a good administration program, the option for BTW verlegd and VAT number validation is always at hand.