B.V. Company in the Netherlands: Guide for Entrepreneurs

More and more entrepreneurs in the Netherlands are considering switching from a sole proprietorship (ZZP – zelfstandige zonder personeel) to a B.V. (Besloten Vennootschap) – a private limited company. While this legal form offers many advantages, making the switch isn’t always a simple decision.

In this guide, together with Dariusz Kurek, owner of KUREK Administratieve Diensten B.V., we explain the key differences, benefits, and obligations of running a B.V. in the Netherlands.

ZZP vs. B.V. – What’s the difference?

Before deciding, it’s important to understand how these two business forms differ:

| Feature | ZZP (Eenmanszaak) | B.V. (Besloten Vennootschap) |

|---|---|---|

| Number of owners | 1 person | 1 or more shareholders |

| Startup process | Simple KvK registration | Notarial deed + KvK registration |

| Setup cost | €82.25 (KvK fee) | €750–1500 + €82.25 (KvK) |

| Liability | Full personal liability | Only company assets at risk |

| Taxes | Income tax + VAT | Corporate tax (CIT), dividend tax, salary tax, VAT |

| Hiring employees | Allowed | Allowed |

| Closing the business | KvK deregistration | Formal liquidation + public notice |

Dariusz Kurek explains:

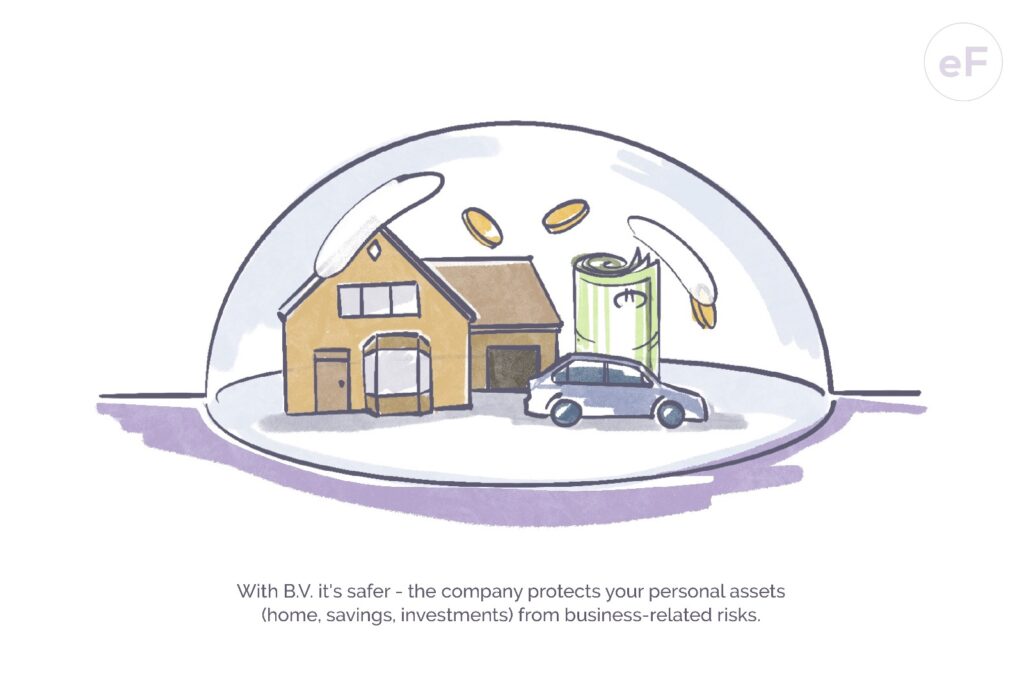

“In a ZZP, all liability is personal. If debts or claims arise, your private assets are at risk. In a B.V., liability is limited to company assets, which protects your personal belongings like your house or savings.”

Still not sure if ZZP is right for you? Read more here.

Who should consider switching to a B.V.?

Entrepreneurs often choose a B.V. when they:

- earn over €115,000 gross per year,

- work in high-risk industries (e.g. construction, consulting, IT),

- want to attract investors or sell shares,

- plan to sell the business in the future,

- aim for a more professional image (B.V. is seen as more prestigious in the Netherlands).

Dariusz Kurek shares:

“Many of my clients start as ZZP but later feel their business has grown. If you take on bigger risks, contracts, or expansion plans, a B.V. is the next step. But remember – it comes with extra obligations and costs. Make an informed decision.”

Wondering what other legal business forms exist in the Netherlands? Check here.

What are the benefits of a B.V.?

1. Protection of personal assets

In a B.V., the company – not the person – is responsible for financial obligations. This means your private assets (home, savings, etc.) are protected from business risks.

2. Tax advantages

A B.V. pays corporate income tax (CIT) instead of personal income tax. In 2025, the CIT rate is:

- 19% for profits up to €200,000

- 25.8% for profits above €200,000

This is often lower than the progressive personal income tax, which can reach up to 49.5% in higher brackets.

You can also optimize your income:

- Pay yourself a salary (subject to income tax)

- Take the remaining profit as dividends (taxed separately)

Dividend tax (box 2) is 24.5% or 31%, depending on the amount – which can result in lower total tax compared to ZZP.

3. Opportunity to attract investors or partners

In a B.V., shares can be sold or transferred without closing the business. This makes it easier to bring in a partner or investor.

4. Stronger company image

A B.V. appears more established and trustworthy – which can help win bigger clients and contracts.

What are the costs and administrative duties?

Monthly costs of running a B.V.:

- €300–400 for standard accounting

- €400–500 if using a holding structure (Holding B.V. + Operational B.V.)

- Extra costs for high transaction volume or complex company structure

- Payroll administration and tax advice as needed

Administrative responsibilities:

- Incorporate with a notary

- Run full payroll administration (mandatory director salary)

- File regular tax returns:

- VAT (BTW)

- Wage tax (loonheffing)

- Corporate tax (CIT)

- Dividend tax

- Submit annual financial statements to the Chamber of Commerce (KvK)

- Document board decisions, e.g., dividend distributions

Dariusz Kurek advises:

“Running a B.V. means more admin work than ZZP. You must file annual reports, set your own salary, and formally record decisions. Without the support of a good accountant and tax advisor, it’s easy to make mistakes.”

Is a B.V. always the right choice?

Not always. A B.V. might not be beneficial if you:

- earn less than €100,000 per year,

- work in a low-risk industry,

- don’t plan to scale or take on investors.

In such cases, ZZP is often more practical and affordable.

Switching to a B.V. makes sense when the financial benefits, asset protection, and growth potential clearly outweigh the added costs and formalities.

Dariusz Kurek sums it up:

“Deciding to form a B.V. should be based on your actual business needs and risks. A B.V. is a powerful tool – but only when used properly. That’s why I always recommend consulting an expert before making the move.”

Still unsure if a B.V. is right for you? Before making a decision, schedule a consultation with a trusted advisor to weigh the pros and cons.

Dariusz Kurek is the founder of KUREK Administratieve Diensten B.V.. Since 2009, he has helped businesses in the Netherlands manage their finances, specialising in both ZZP and B.V. structures. He offers tax advice and helps clients optimise their business setup.