Fighting False Self-Employment in the Netherlands

Starting January 2025, the Dutch tax authorities plan to tighten controls to combat schijnzelfstandigheid – false self-employment.

Although the DBA (Deregulation of Employment Relationships Act) has been in force for several years, it has not been strictly enforced. Companies and freelancers have operated in a “grey area” without consequences. This situation will change next year as the tax office begins rigorous checks. Clients will need to prove that their freelancers (ZZP’ers) genuinely operate as independent businesses, rather than working under conditions similar to salaried employees.

What is False Self-Employment?

False self-employment occurs when you formally work as an entrepreneur, but your working conditions resemble those of an employee. For instance, if you’ve been working for only one client for years, who dictates your hours and how you perform tasks, the tax office may decide that you should be employed rather than operating a business, as your company is essentially a fiction.

Expert Comment:

“This phenomenon is undesirable for several reasons, primarily due to its social impact as emphasized by politicians. The main issue is social security. People in hidden employment, especially at low rates, cannot secure their future. They can’t afford disability, accident, or pension insurance. Consequently, if they fall ill, have an accident, or retire, they will be left without financial support. Additionally, hidden employment negatively affects public finances, as the state collects fewer taxes. Other taxpayers are ultimately burdened with covering this deficit to balance the state budget.”

— M. Paczesny

What Could It Look Like in Practice?

ake the construction industry, for example. If you’ve worked for the same construction company for years, start every day at the same time, follow the manager’s orders, and have no freedom in choosing your tools or methods, this situation raises red flags. Even if you issue invoices, the tax office might conclude that you’re actually an employee rather than an independent contractor.

Another suspicious situation is called inbedding – embedding. This refers to working in a way that aligns closely with the client’s business. For example, a carpenter working on a project for a carpentry company may be flagged, whereas a carpenter working for a hair salon wouldn’t raise the same concerns.

What Risks Do the New Regulations Bring?

If the tax office determines that a freelancer operates under false self-employment, the client will be required to pay the freelancer’s back taxes and social security contributions for the past five years.

This financial risk may prompt companies to terminate their relationships with many ZZP’ers, as some are already doing. For example, public broadcaster NOS has terminated contracts with several freelancers.

In addition, a freelancer flagged for false self-employment will lose their right to tax benefits.

Expert Comment:

“It’s estimated that around 200,000 people in the Netherlands operate in hidden or false self-employment. For these individuals, the risk lies in losing tax benefits typically available to self-employed persons, such as zelfstandigenaftrek, startersaftrek, or mkb-winstvrijstelling. Depending on income, this could result in thousands of euros in additional tax annually.”

— M. Paczesny

How Can You Avoid Being Accused of False Self-Employment?

Mind the Formalities

The best evidence for a tax inspector is a contract with your client that clearly outlines your offer, scope of work, and price. This demonstrates that your client does not dictate your working conditions, and you act autonomously. In industries where long-term cooperation is common (like construction), it’s crucial that your independence is highlighted in the contract.

Starting a project with a formal quote also ensures that the terms between you and the client are clearly regulated and proves that you work independently.

Learn how to create a good quote in the construction industry HERE.

More Than One Client

The more clients, the better. Having several clients is strong proof that you run a truly independent business. In many industries, particularly construction, it’s easy to find a few smaller side projects, which could protect you from potential issues with the tax office.

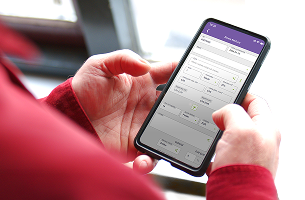

Documentation Equals Safety

Keep your business records in order. Contracts, invoices, time logs, mileage records, and business expenses – all of this could be crucial in the event of an audit.

Read about how to have great cooperation with your acoountant HERE.

At eFaktura.nl, we make it easy to organize and archive all your important documents. Record your business expenses, log your working hours, and track mileage in the app – everything is at your fingertips.

Have Doubts? Consult a Specialist!

If you have concerns, it’s worth consulting a lawyer or tax specialist who can help you assess whether your cooperation with clients complies with the new regulations. This is especially important if you operate in an industry where long-term relationships with one client are common.

You can also take the self-employment test prepared by the Belastingdienst HERE.

We want you to feel safe under the new regulations.

eFaktura.nl is more than just simple invoicing. Use our features to better organize your business documentation. By issuing QUOTES, you confirm your independence in the client relationship, while logging work hours and tracking mileage demonstrate transparency to the tax authorities and show that you’re your own boss!

New regulations may raise concerns, but with the right knowledge and preparation, you can rest easy. Ensure your agreements with clients are clear – draft a contract or offer before every project. The more details you collect about your working arrangements, the easier it will be to prove that you meet all the formal requirements to be a ZZP’er.

We’ll keep you updated on any new changes and conditions related to this topic. If in doubt, consult a financial advisor.

Expert commentary provided by

M. Paczesny, tax and legal advisor at EU-TAX B.V.

eu-tax.amsterdam

Sources:

nos.nl

paperdork.nl

deondernemer.nl