Running a KOR-Based Business in the Netherlands

If you’re thinking of starting a small business, it might be worth considering the KOR (Kleineondernemersregeling) scheme. This article explains what exactly KOR is, who benefits from it, and how it differs from operating a sole proprietorship under the general rules (ZZP).

What is a KOR-Based Business?

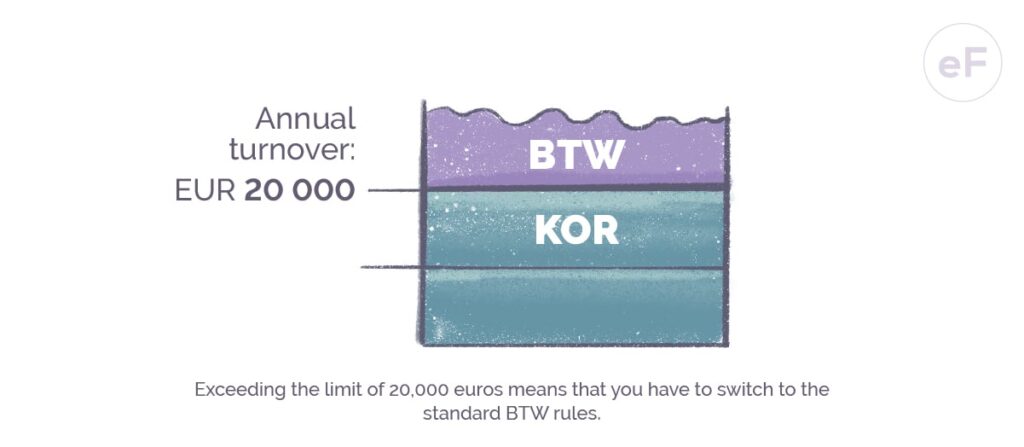

KOR is a tax scheme for small business owners. It allows exemption from VAT (known in Dutch as BTW) if your annual turnover does not exceed €20,000. In practice, this means you don’t have to add VAT to your invoices or pay it to the tax authorities.

Who is KOR Suitable For?

A KOR business is a good option for those running small businesses, freelancers, and newcomers to entrepreneurship.

Curious about the types of businesses you can start in the Netherlands? Read HERE.

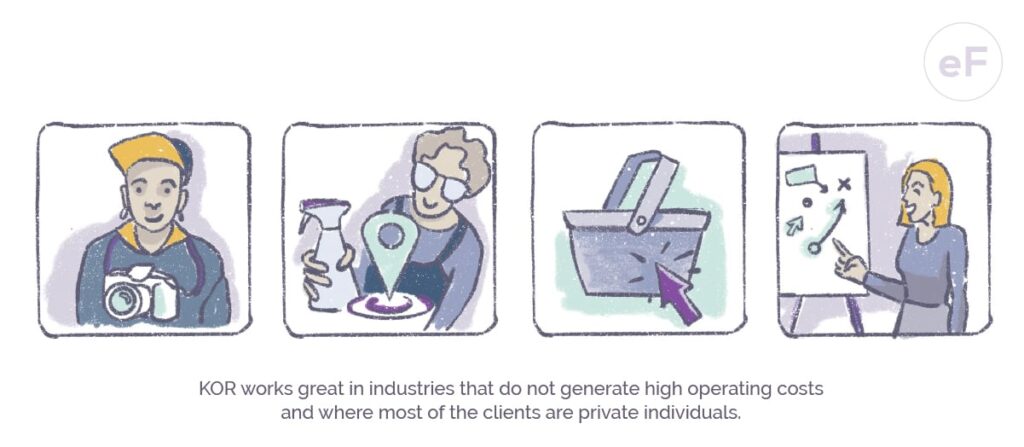

Which Sectors Commonly Use KOR?

KOR works best in industries with low operating costs and primarily private clients. Examples?

- Creative Sector: Are you a graphic designer, photographer, or interior designer? KOR can simplify your tax obligations.

- Local Services: If you offer minor repairs, cleaning, or childcare services, KOR lets you avoid complex VAT calculations.

- E-Commerce: Selling crafts, books, or other products online? If your turnover is low, KOR might be very beneficial.

- Education and Training: If you provide courses, workshops, or individual training, you don’t need to add VAT to your invoices, which can be advantageous for clients.

Exemption from VAT can make your products and services more affordable, enhancing your competitiveness.

Check out the Belastingdienst tool HERE to see if KOR is right for you.

Employed? You Can Combine KOR with Your Job!

There are no legal restrictions in the Netherlands against running a KOR-based business alongside your job. Many people choose this setup, especially when starting their entrepreneurial journey.

- Time and Task Management: You can work full-time or part-time and run your business simultaneously. Managing time well and fulfilling both employer and client obligations is key.

- Tax Returns: Income from your job and business are reported together in your annual tax return.

- Tax Benefits: Even if employed, you can still claim entrepreneurial tax benefits like zelfstandigenaftrek (self-employed deduction) or startersaftrek (startup deduction) if you meet the hours requirement (at least 1,225 hours annually).

- Employer Approval: Before starting, check your employment contract for clauses that restrict additional business activities, especially if it overlaps with your employer’s industry.

Points to Consider When Combining KOR with Employment

- Expense Management: Clearly separate personal and business expenses. Ensure all business transactions are well-documented.

- Insurance: Your health insurance may be covered by your employer, but if you have a business, consider additional insurance like liability (AVB) or income protection.

- Administrative Duties: While KOR reduces your VAT obligations, you still need to maintain accurate records and track your turnover. Exceeding the €20,000 limit will require switching to the standard VAT rules.

Differences Between KOR and ZZP Businesses

Running a KOR-based business differs from a regular sole proprietorship (ZZP) mainly regarding VAT and administrative duties.

- VAT: With KOR, you neither charge nor remit VAT. In a standard business, VAT is accounted for on each invoice.

- Invoicing: Invoices issued by a KOR business don’t include VAT. This benefits individual clients (lower costs), but business clients can’t claim VAT deductions.

- Business Expense Deductions: In KOR, you can’t deduct VAT on business expenses, which matters for larger investments.

- Administrative Obligations: KOR reduces VAT-related obligations, meaning you won’t submit quarterly VAT returns, saving time and reducing accounting costs.

eFaktura.nl enables your small KOR-based business to issue professional invoices. You can also use other app features to streamline administrative tasks.

Key Administration Tips for a KOR-Based Business

- Track Turnover: Regularly monitor your turnover. If you exceed €20,000, you must adopt the standard VAT rules and pay VAT on all income.

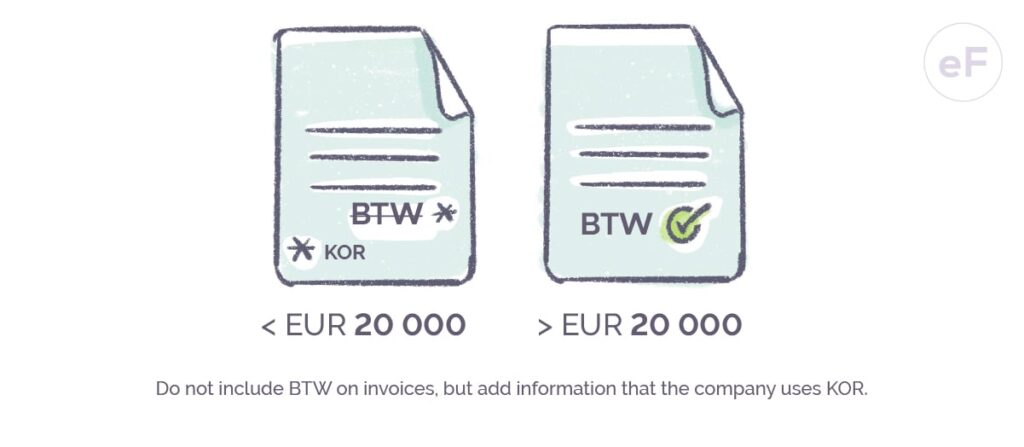

- Invoicing: Don’t include VAT on invoices but note that your business uses KOR.

- VAT Deductions: With KOR, you can’t deduct VAT on business purchases, so consider larger investments carefully.

- Annual Declaration: While KOR exempts you from quarterly VAT returns, remember to file your annual income tax declaration.

- Keep Up with Changes: Stay informed about any changes to KOR regulations that may impact your business.

What Happens If You Exceed the €20,000 Limit?

If you exceed €20,000 in turnover, you’ll switch to standard VAT rules. This means every subsequent invoice must include VAT, which must be remitted to the tax authorities. While your company’s name or legal form remains unchanged, your tax status does, requiring VAT compliance until the end of the current and following fiscal years.

Is Invoicing Mandatory for a KOR Business?

Not always. Invoicing is required when selling products or services to other businesses (B2B). For private clients (B2C), invoices aren’t mandatory unless requested. However, always document income through other means, like receipts, records, or contracts.

Documenting Turnover for a KOR Business

Even without invoices, you must keep accurate income records. Every deposit to your business account should be recorded. Consider using spreadsheets or an administrative system for entrepreneurs. Sales receipts, client agreements, and payment confirmations are also helpful—professional software, like eFaktura.nl, can assist here.

While KOR businesses aren’t required to have a separate bank account, a dedicated account for business income simplifies financial tracking and is useful during audits.

KOR Program Changes Starting January 1, 2025

Key updates beginning in 2025 include:

- Online Registration: Joining KOR will only be possible via online registration.

- Minimum Participation Period Removed: The current minimum KOR participation period of three years will end. From January 2025, you can leave KOR at any time.

- New Waiting Period: After leaving KOR, businesses won’t need to wait three years to rejoin. Instead, they’ll be eligible from the end of the following calendar year.

- EU-KOR Option: An EU-wide KOR scheme will allow businesses to operate in other EU countries without VAT registration locally. Available to businesses headquartered in the Netherlands, this option applies if annual turnover across all EU countries doesn’t exceed €100,000.

Operating under KOR is ideal for small businesses with low costs and mainly private clients. It’s also beneficial if you’re just starting or combining business with a job.