Changes in regulations for companies in the Netherlands.

Tax law must be constantly adapted to economic changes. And this time, the Dutch government has prepared regulations that directly apply to entrepreneurs.

Are you ZZP? See what changes in regulations are impotrant for company?

1. The minimum wage goes up.

The high price of energy translates into higher product prices, which in turn causes high inflation. According to the difficult economic situation, the Netherlands introduced a 10% increase of the minimum wage. By raising the minimum wage, lowering income tax and increasing tax credits, the government wants to increase purchasing power and thus overcome the economic crisis.

Are you wondering how to reasonably raise prices in your company? Find out how to do it HERE.

2. No more fake discounts.

The EU directive (Omnibus) on transparent rules for product discounts has also been introduced in the Netherlands. From now on, the seller is obliged to inform the consumer about the lowest price of the discounted goods or services which was valid in the last 30 days.

3. Do you have a reason to hide your business address? Now you can!

From December 15, 2022, a regulation protecting your company’s address data entered into force. It means, that if for some reason you want to keep the address of the registered office secret, you can do it now. This mainly applies to cases where you feel threatened for some reason. Use this right with caution, because access to the company’s address details makes you more credible in the eyes of contractors.

4. Co-financing of a nursery and kindergarten without the criterion of hours for entrepreneurs.

Until now, the amount of co-financing for a child care facility depended on the working hours of a self-employed parent. From now on, this criterion is abolished, and the rules for granting funding are simplified. The change will be especially appreciated by enterprising parents with irregular working hours.

You can read more about benefits for mothers running a business HERE.

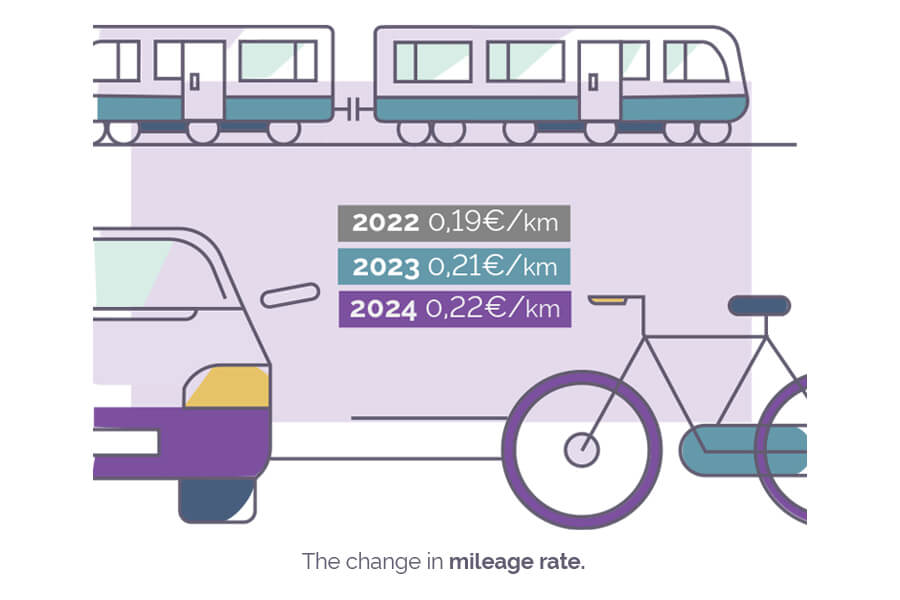

5. Mileage goes up.

In response to increases in fuel and public transport prices, the mileage rate was raised from €0.19 to €0.21. At the same time, the government announced another increase – €0.22 for 2024.

The change applies to full-time employees (for the route to the place of work) and entrepreneurs who settle the mileage.

In the case of employees, the employer pays an amount calculated at a fixed rate. Self-employed people subtract mileage from their tax base, thereby reducing their income tax.

You can read how to calculate the mileage in the best way HERE.

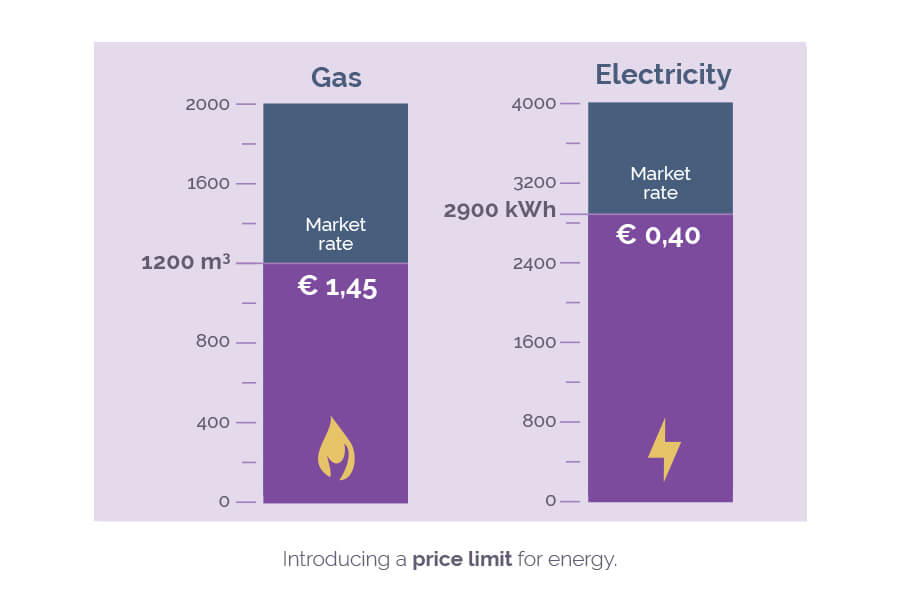

6. Energy price limit.

The government has introduced energy price regulation for small businesses to better anticipate the costs associated with doing business. The price cap means you pay €1.45 per m3 of gas up to a maximum of 1,200 m3 and €0.40 per kWh for electricity up to a maximum of 2,900 kWh. Consumption above the set limits will be charged at market rates.

TEK program.

At the same time, you are entitled to an allowance for energy costs (TEK) if you use more than 5,000 m3 of gas or 50,000 kWh of electricity per year and if at least 7 percent of your turnover is energy costs.

The TEK program and price cap are valid until the end of 2023.

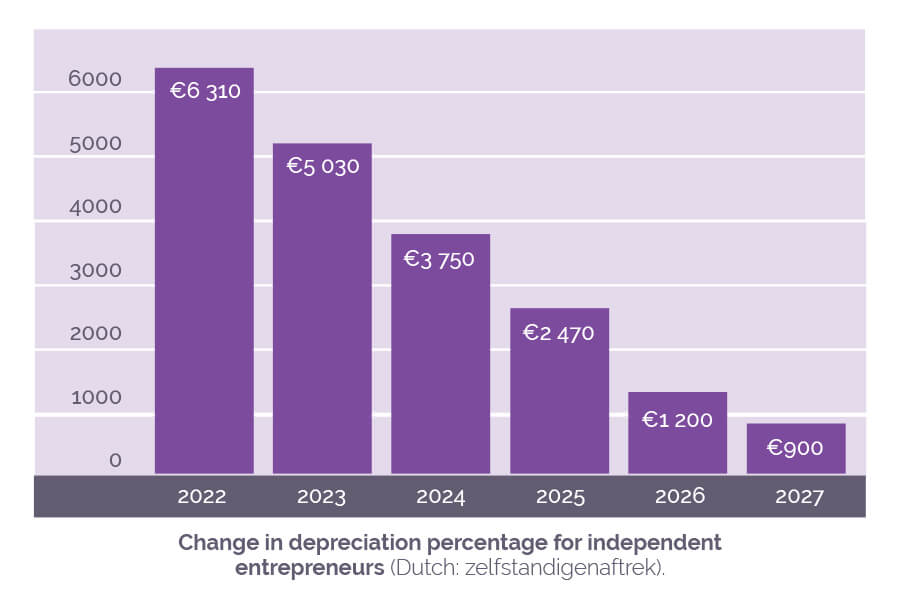

7. Reduction of zelfstandigenafrek.

When calculating the amount of income tax, you have the right to deduct the amount for independent entrepreneurs related to meeting the hourly criterion. This deduction has been reduced by €1,280 in 2023 to a total of €5,030.

In the following years, the government plans to regularly reduce this amount, eventually the zelfstandigenaftrek is to amount to €900 in 2027.

Read more about the hourly criterion in running a business HERE.

8. Announcement of changes for the construction industry.

The government also announced changes in the construction industry to be introduced in 2023.

Firstly, in order to improve the level of services and better protect the interests of consumers, companies in the construction industry will be required to engage an independent and certified quality controller who will verify the quality of the service provided.

Secondly, the liability of construction companies will also increase – as the owner of a company, for example a renovation company, you will also be responsible for hidden defects that will come to light after the service has been performed.

Moreover, the presence of a safety coordinator will soon be necessary for construction and demolition works.

Source: www.kvk.nl