How to use your vehicle, mileage and bijtelling in the Netherlands

Private or company car? How do you use a company car without getting lost in tax regulations and how do you avoid bijtelling?

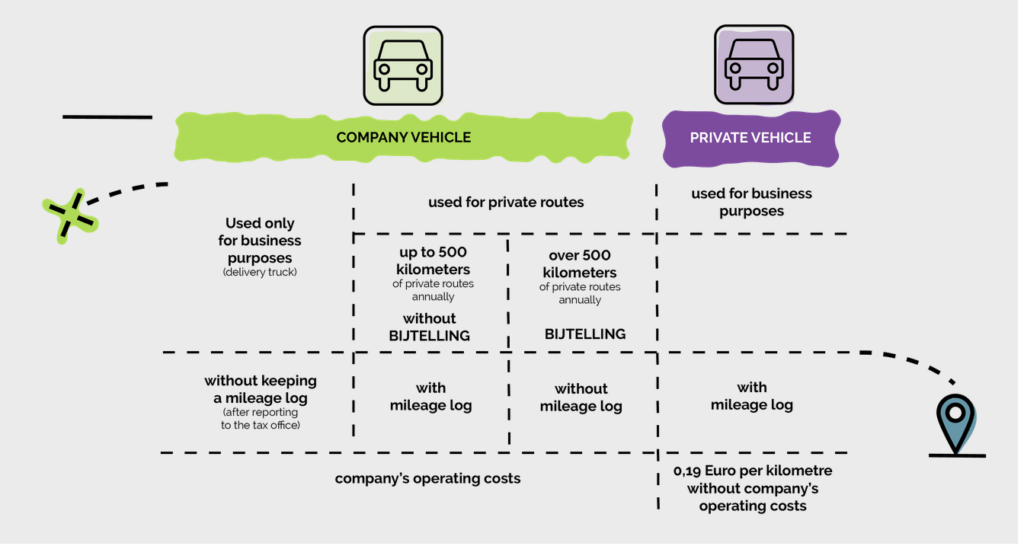

The decision on how to use your vehicle is important for an entrepreneur. Especially from a fiscal point of view. Do you choose a company of private car? Each one of these option had a different way of recording routes. Which one will be best for you? And what bijtelling means for your business?

Ways to settle mileage in the Netherlands:

1. Company car

By choosing a company delivery van that is declared to the tax authorities, you can benefit from the highest cost deduction. This model assumes that you only use the car for business purposes. In that case, the Belastingdienst will exempt you from the mileage obligation. You can even request a reduction in your road tax rate.

In the case of a company passenger car, you must keep a route register, unless you decide to pay a surcharge (bijtelling – more on this below). In fact, you can include any cost (not including traffic fine) associated with owning a car in your tax settlements. Lower taxes? Check this way! Click HERE.

Deductible company car costs:

- fuel

- parking

- repairs

- insurance

- road tax

- depreciation

- leasing instalment

2. Do you use your company car privately? Meet: bijtelling!

A common practice is to use a company car for private purposes.

The key here is to keep a mileage register (taking into account the meter reading) so that in the event of a tax audit it’s easy to justify the settlement of costs. How to correctly drive mileage in the Netherlands? Read all about it HERE. If you fail to meet this obligation, you may face a financial penalty in the event of a tax inspection.

Do your private routes exceed 500 kilometres per year? You have to pay bijtelling!

What is bijtelling?

Bijtelling is a surcharge for the private use of a company car. It increases your income amount, which is the tax base. This results in a higher tax, because the more income you show, the more tax you pay.

So, bijtelling isn’t the most pleasant. Especially because it is usually quite a high amount – depending on the list price of the vehicle. It can even increase to several thousands of euro’s!

How to escape from bijtelling?

Record every route you travel, and tag which routes are business and which are private. When using the KILOMETER tool in eFaktura, the registration system is always at hand.

Do you have a company and do you have a car? Drive KILOMETERS simply and comfortably!

Use the RDW database, Google Maps integration and geolocation functions.

ADD YOUR ROUTE in Efaktura

Systematically adding routes on your phone is the easiest method to avoid paying bijtelling. This way, you fulfil your administrative duty and monitor your private kilometres travelled on an ongoing basis.

3. Private car used for business purposes

This way of using your car also requires you to drive kilometres! In this case, when recording each route travelled for business purposes, you can deduct the rate of EUR 0.19 per kilometre. You will be able to deduct the amount collected in this way from your income in the tax return. This means that each business kilometre travelled can be included in the costs of running a business.

When deciding on the method of registering kilometres, remember that your regularity will largely depend on the functional tool you choose. By ensuring regularity, you guarantee yourself the best tax breaks – and it pays off for you and your company.