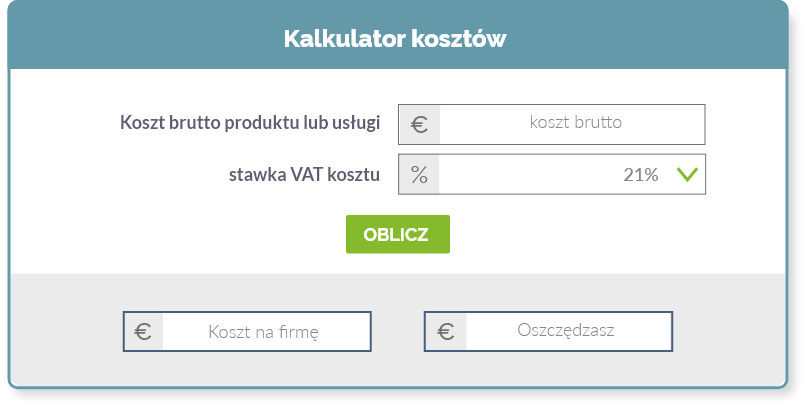

Company’s expenses calculator

Why are operating expenses essential for running a business?

They lower the taxable amount (tax base), which means they reduce your company’s income. Lower income means less tax. The rule is simple – the higher your operating expenses the less tax you pay.

Being a VAT payer can give you the opportunity to subtract the VAT rate from the expenses of your company’s purchases. Thus reducing your income tax and subtracting VAT tax is simply in your best interest.

Who can benefit from our calculating software?

Every entrepreneur from Holland, Belgium, Germany or Poland can use our expenses calculator. It’s been precisely adapted to all VAT rates that are valid in the countries in which eFaktura can be applied.

Got a construction business? Check how much you can save by buying a new hammer drill. Running a cleaning company? Find out how much you can earn by deducting all expenses for cleaning supplies.

Coming soon

How to use our company’s expenses calculator?

- Enter gross value of the purchase ( with VAT).

- Enter VAT rate of purchase (you can find it on your receipt).

How much exactly can you save?

The calculator will estimate the expenses of your purchase reduced by VAT tax.

Do you find our calculator useful?

Share.

You can check out all the cool features

by signing up for a 30 day

free trial period.

After the trial period just choose the package that best suits your company.

Any doubts?

eFaktura software

works with KVK RDW and VIES databases.

Every software feature was created accordingly with tax systems of the country, where your company is located.