Mileage tracking pays off!

Business trips are a company cost. If registered correctly, you can deduct them in the mileage tracker.

Google Maps integration calculates the distance automatically.

Geolocation fills in your current location.

Live preview of your business mileage deduction.

Mileage tracking helps you save

What do you gain from using mileage tracking?

Mileage = business expense

To deduct mileage expenses, you must keep a travel log that meets the requirements of the Dutch tax office. A properly maintained mileage record will qualify you for a tax deduction.

Avoid bijtelling

Consistently logging trips helps you avoid Dutch bijtelling. It’s the easiest way to stay compliant and keep track of your 500 km private use limit.

Had to take a detour to your client?

Sometimes, at the final stage of a project, mileage turns out to be a significant part of your service costs. That’s why it’s smart to include it in your final billing. With proper mileage records, it’s easier to negotiate with clients.

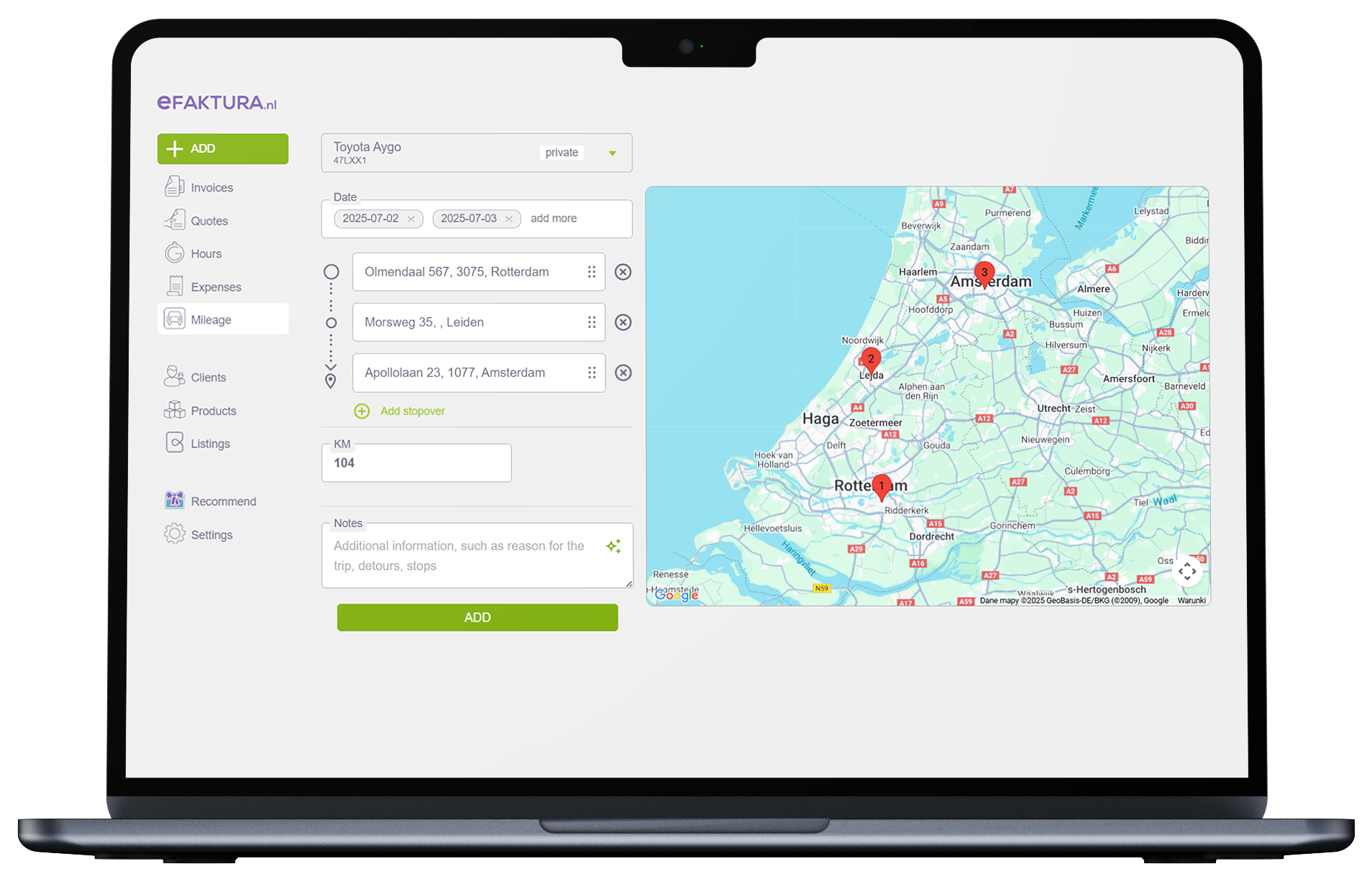

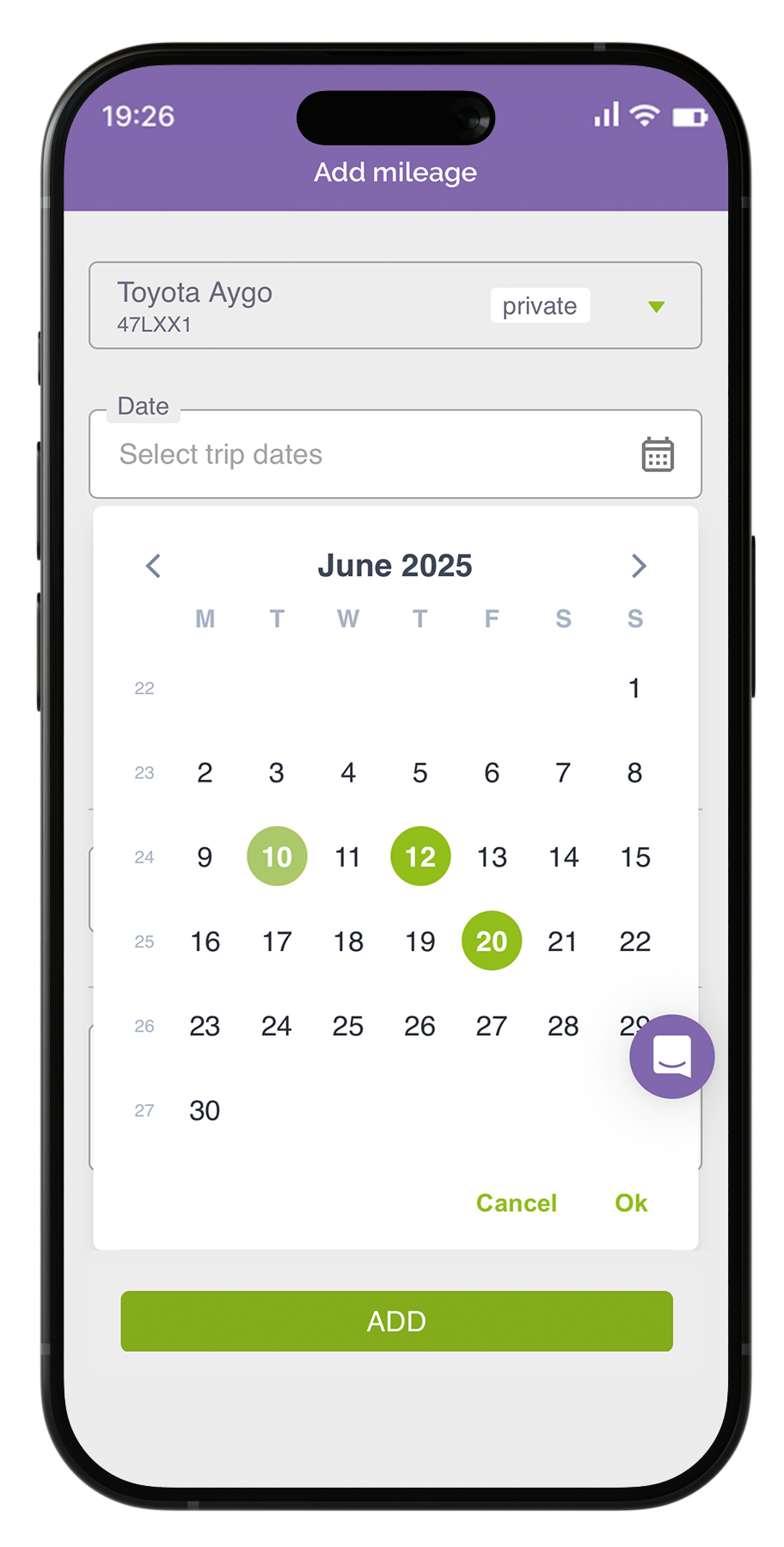

What does mileage tracking look like in eFaktura.nl?

User-friendly interface makes regular logging simple.

Desktop version shows start and end points.

LOG TRIPS WITH EASE

The mileage feature in eFaktura.nl is packed with smart tools!

Google Maps integration

Accurate and faster trip logging, map preview in desktop version.

Geolocation

Atomatic location detection when adding a trip

Multitrip

Register a trip with multiple stops (e.g. client ➝ warehouse ➝ client).

Live deduction preview

Instantly see how much you can deduct for business mileage.

Vehicle management

Easily switch between cars.

Bijtelling counter

Track private mileage, stay under 500 km limit.

Mark private sections

Easily split private parts from business routes.

Accountant access

The accountant can directly view and process your mileage log –

no need to send reports manually.

Multidate

Enter a route once and apply it to multiple days – perfect when working from a single location.

RDW Database Integration (NL)

Automatically fetch vehicle data based on the license plate number

Registration of routes by other means of transport

Possibility to log routes taken by bike, train, or other means of transport

PRIVATE OR BUSINESS?

How does mileage registration work in the Netherlands?

The tax office imposes several administrative requirements for business mileage logging. Meeting them can significantly reduce your business costs.

Discover the general rules of mileage registration.

COMPANY CAR

PRIVATE CAR

used only for business

(commercial vehicle)

used for private trips

used for business purposes

up to 500 km private trips per year

no BIJTELLING

over 500 km of private trips per year

BIJTELLING

with mileage registration

no mileage log required

(if reported to tax office)

with mileage registration

without mileage registration

operating costs charged to the company

€0.23 per kilometer without company expenses

FAQ

A mileage log is a feature that allows you to register business travel routes that can be claimed as business expenses – even if you’re using a private car, bike, or public transport.

The feature is available to all business owners – whether using private vehicles for business purposes or company cars.

– Car make and model

– License plate number

– Odometer reading before and after the trip

– Route details – starting point and destination

– Trip type – private or business

– Extra notes (e.g. detour)

No. You can log business trips using a private vehicle. You’re allowed to deduct €0.23/km as a business expense according to Belastingdienst rules.

In eFaktura.nl, you can log car, bike, train, or any other form of transport – every business kilometer counts!

Multiroute: Save a route with multiple stops.

Multidate: Duplicate the same route across multiple days – perfect if you travel to the same location often.

Yes. The system gives you a real-time overview of deductible mileage costs – especially for businesses in the Netherlands.

Bijtelling is an additional tax for private use of a company vehicle. With the built-in mileage counter, you can track your private kilometers and stay under the 500 km annual limit.

Yes – you can mark part of a route as private to ensure accurate and compliant reporting.

Of course! You can add all your vehicles and easily switch between them in the main mileage tracking view.

Not if your accountant has access to your eFaktura.nl account. Otherwise, generate a summary and share it with them.

Yes. The system is integrated with the RDW database, the Dutch vehicle registry – this allows vehicle data to be automatically retrieved based on the license plate number.