Minimum hourly: what does it mean for ZZP?

From 1 January 2025, the minimum hourly wage in the Netherlands for employees aged 21 and over is €14.40 gross. From January 2026, it will increase to €14.71 gross. This is the highest level in Dutch history.

The goal is clear: the government wants to protect purchasing power and ensure equal pay per hour. This applies regardless of whether a full-time job means 36, 38, or 40 hours per week.

Until the end of 2023, the Netherlands used a minimum monthly or weekly wage. The amount was the same for everyone. However, it was linked to a “full-time” workweek. In practice, full-time hours differed by sector:

- 36 hours, for example in public administration

- 38 hours, for example in retail

- 40 hours, for example in construction

As a result, the hourly wage was not equal. Shorter workweeks meant a higher hourly rate for the same monthly pay.

Since 2024, this has changed. The Netherlands introduced one national minimum hourly wage. Therefore, the system is now simpler and more transparent. Every employee now has a guaranteed minimum pay for each worked hour.

For self-employed professionals (ZZP), this amount is not mandatory. However, it is often used as a reference point. Importantly, it does not include business costs, taxes, insurance, or financial reserves.

The market impact of the minimum hourly wage

The minimum hourly wage affects more than employees only. For ZZP professionals, it works as a psychological lower boundary. It influences:

- client expectations,

- negotiation power,

- competition with agency workers and employees under CAO contracts.

In sectors such as logistics, construction, care, or technology, ZZP professionals often compete with employees. Therefore, the minimum wage becomes an informal benchmark, even if it does not legally apply.

CAO agreements and higher minimum rates

Actual employee wages are often higher than the legal minimum. This is due to CAO agreements (Collective Labour Agreements). CAOs are formal agreements between employers and trade unions. They define working conditions that are often better than national rules.

A CAO may include:

- a higher minimum hourly wage,

- overtime, night, or holiday bonuses,

- holiday allowance (vakantiegeld) of 8% per year,

- rules for seniority, bonuses, and extra benefits.

For ZZP professionals, this knowledge is essential. If competitors work under a CAO, charging close to €14.40 per hour can look unprofessional. In many sectors, CAO rates shape the real market price, not the legal minimum.

Gross, net, revenue, and income explained

These terms mean different things depending on employment type. Therefore, clarity matters.

For employees:

- Gross salary: the amount in the contract

- Net salary: take-home pay after deductions. Taxes and contributions are handled by the employer.

For ZZP professionals:

- Invoice gross: invoice amount plus VAT

- Revenue: invoice amount without VAT

- Costs: business expenses

- Income: revenue minus costs

- Net income: income after tax and health insurance

Employment vs ZZP: the same rate, different reality

For an employee, €14.40 gross per hour means about €2,496 gross per month at 40 hours per week. Net income is roughly €2,200–€2,300, depending on taxes and CAO benefits.

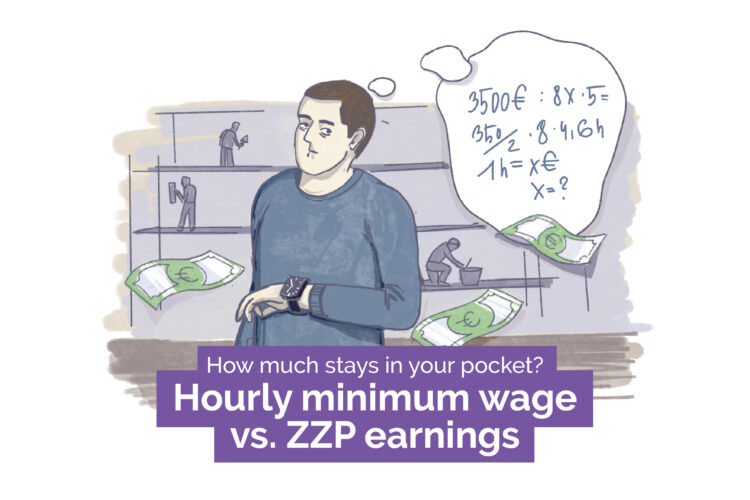

For a ZZP professional, the same €14.40 per hour is not comparable.

After income tax, health insurance, VAT obligations, business costs, and reserves for holidays and illness, the net result is much lower.

Therefore, a ZZP professional must charge more. This is not about profit only. It is about financial balance.

Calculate your hourly rate with the ZZP calculator here.

How much should a ZZP invoice to match an employee?

Assume a ZZP wants a net income of €2,300 per month. This matches the take-home pay of an employee on minimum wage. Now assume an additional €700 per month for health insurance, holidays, pension, sickness, or periods without work. The real target becomes €3,000 net per month.

Let monthly business costs be €500 net. To reach this goal, monthly revenue should be about €3,950–€4,000. After costs, taxable profit is around €3,500. After tax, about €3,000 remains.

Assuming 175 working hours per month, the minimum hourly rate becomes €22.50–€22.80, excluding VAT. Compared to €14.40 for employees, this is 55–60% higher.

In practice, many ZZP professionals charge €25–€40 per hour. Only then can they cover costs and build stability.

Why ZZP rates seem high

Employee minimum wage is a reference point. However, it ignores business reality.

Higher ZZP rates allow professionals to:

- cover real business costs,

- pay private health insurance,

- save for pension and holidays,

- survive periods without work,

- invest in skills, tools, and marketing.

In addition, pricing is a strategy. It depends on experience, competition, CAO levels, and positioning.

Is ZZP worth it? Read more here.

ZZP vs employee: practical comparison

| Criterion | Employee | ZZP |

|---|---|---|

| Net income | Stable | Variable |

| Taxes | Employer handled | Self-managed |

| Holidays | Paid | Self-funded |

| Stability | High | Market-dependent |

| Flexibility | Limited | Full control |

| Deductions | None | Business costs |

| Administration | Minimal | Full responsibility |

How to set your hourly rate as a ZZP

Hourly rates should never be guessed. They must be calculated. A good starting point is the ZZP income calculator on eFaktura.nl. It allows users to:

- set a desired net income,

- estimate business costs,

- define monthly working hours,

- calculate the required hourly rate automatically.

The calculator includes tax allowances and current Dutch tax rates. As a result, it helps avoid underpricing.

Click here to calculate your rate.

A well-calculated rate is the foundation of stable ZZP work

An hourly rate is more than a number on an invoice. It defines financial stability and work comfort. It must include taxes, costs, non-billable time, investments, and reserves.

Relying on real data is essential. Self-employment brings more risk and responsibility. Therefore, the rate must provide security and quality of life. A strong rate allows smarter work, conscious income, and space beyond work.

This article is for informational purposes only and does not constitute legal or tax advice. Regulations and rates may change. Always consult a tax advisor or accountant before making financial decisions.