Road tax and other costs for drivers.

It’s going to be an expensive year for drivers in the Netherlands. Since the beginning of the year, the MRB road tax and the BPM vehicle purchase tax have increased.

What else changes to the disadvantage of vehicle owners? And where is it worth looking for savings?

There is nothing to complain about the state of roads in the Netherlands. The road infrastructure is in good condition and allows you to move around the country efficiently. However, every road user here knows the costs of this pleasure. All motor vehicle users are contributing to the condition of motorways by paying high road taxes, which are even higher this year.

Do you have a car in the Netherlands? Meet MRB

Road vehicle tax is MRB, in other words “motorrijtuigenbelasting”. This is the basic fee that

drivers living in the Netherlands have to pay, regardless of the country in which the vehicle is registered.

Register your car in the tax office.

Road tax applies to every driver staying in the Netherlands for more than 3 months. After that, you are obliged to register your vehicle with the Belastingdienst (Tax Office). To do this, you must complete a special declaration for cars registered outside the Netherlands called”Aangifte

motorrijtuigenbelasting buitenlands kenteken en ongekentekend motorrijtuig” (this declaration can be found HERE). This procedure takes up to 8 weeks.

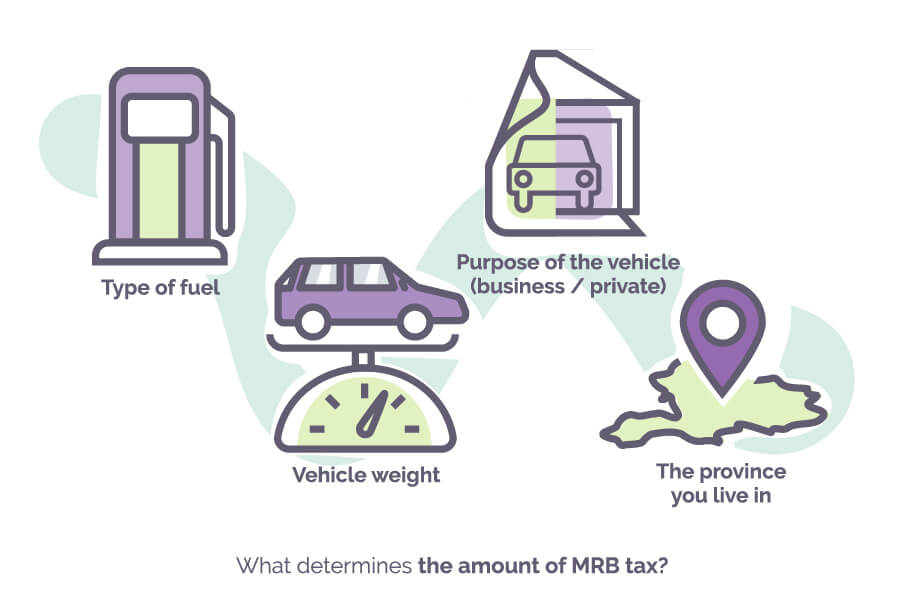

What determines the amount of MRB tax?

The tax is calculated quarterly or annually, and its amount is affected by several factors:

1. Type of fuel.

For instance, owners of diesel cars pay the largest amount and owners of electric cars pay the least.

2. Vehicle weight.

Larger cars usually emit more exhaust fumes and use the roads more with their weight. That is to say, the principle of “heavier pays more” applies.

3. Purpose of the vehicle (business or private).

Cars intended for private use pay less tax than company cars.

4. The province you live in.

Part of the tax amount is managed locally by the provincial government. The other part of the amount of road tax is administered centrally by the Ministry of Transport.

Higher MRB in 2023.

This year, six out of twelve provinces increased the MBR amount. Meanwhile, the Dutch government introduced an inflation adjustment by raising the tax by an additional 6.3%, which will probably be felt by every motor vehicle owner. You can calculate the tax amount for your vehicle on the website of the Dutch tax office HERE.

Are you planning on buying a car? Meet the BPM tax.

Vehicle purchase tax is in Dutch “belasting van personenauto’s en motorrijwielen,” or “BPM”. This is a one-time payment you make when you buy a new vehicle registered in the Netherlands.

What determines the amount of BPM tax?

The BPM tax is calculated on the basis of CO2 emissions as well as the age and class of the car. That is why it is often called the “luxury tax”.

In other words, the more expensive and better equipped the car is, the higher the BPM.

Owners of fully electric cars are completely exempt from the BPM tax. This exemption is valid until the end of 2024. In this way, the Dutch government wants to encourage drivers to buy an environmentally friendly car.

Entrepreneurs who have a delivery vehicle registered to their company can also avoid BPM. However, several requirements must be met beforehand:

– You must have the status of an entrepreneur in the eyes of the tax office,

– Your delivery vehicle should meet the conditions for BPM (you can read the detailed

requirements HERE),

– more than 10% of kilometers traveled annually by a delivery van are your business routes.

Higher BPM in 2023.

What has changed in the calculation of the BPM tax is the reduction of CO2 limits. In practice, this means raising tax rates for lower limits. In conclusion, a higher BPM tax will be paid by anyone who registers a car other than electric.

Expect a significant increase in fuel prices soon.

Due to the economic crisis, the government introduced a reduction in excise duty on fuels in April 2022. This excise duty was to be in force until the end of last year. This period has been extended to July 2023.

After that, you can expect a price increase by the previously reduced excise duty, and additionally the government intends to increase prices by the inflation adjustment (planned 6.3%). This means that a liter of fuel will be significantly more expensive, which, as we all know, will translate into further increases in products and services.

The only good increase – mileage goed up.

Taking into account the changes above, raising the mileage rate seems to be really important and beneficial for entrepreneurs.

From now on, for each shown kilometer driven for business (this applies to self-employed as well as full-time employees commuting to work) you can deduct a higher amount. This year the current rate is €0.21 (instead of €0.19). An increase in the rate to €0.22 in the next year was also

announced.

This means that reliable registration of kilometers will be a way to at least partially compensate for the costs incurred on other taxes related to the use of a car.

You can read more about the benefits of systematic mileage registration HERE.