Tax changes for ZZP from July 1, 2022.

Are you running a company in the Netherlands? See what the Dutch government has prepared for you and your company. Find out about the most important changes for ZZP.

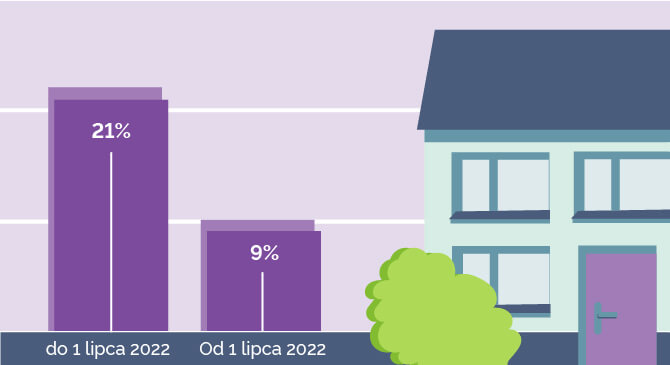

1. Lowering the VAT rate for energy

Nowadays the whole world is struggling with rising energy prices. The economic crisis caused by the pandemic and the war in Ukraine – these factors affect the unfavourable price of energy resources, which directly translates into each sector of the economy. Tax changes for ZPP are designed to, at least partially, remedy this situation. This is why the Netherlands are reducing the VAT rate for energy (natural gas, electricity and heating) from 21% to 9%.

As of yet, the reduction is expected to apply until the end of this year. You need to reduce taxes? Try by better in expenses registration.

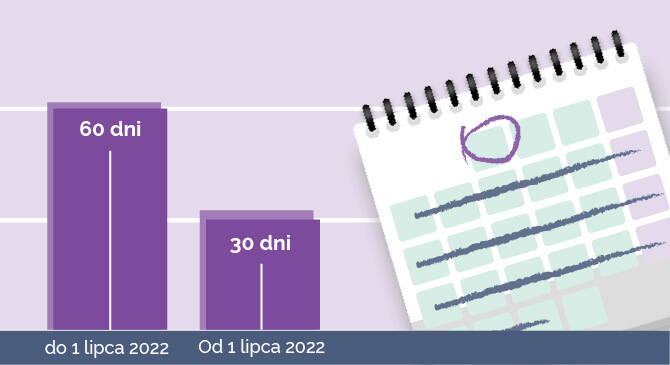

2. Payment terms for large companies.

The Dutch government also took care to improve financial liquidity among small companies providing services to large enterprises, which until now had a statutory 60-day payment period for invoices. These were very unfavourable times for small entrepreneurs, which caused many companies to get into financial difficulties.

From July 1st, you can invoice your large clients with a 30-day payment period. Thanks to this, you will receive payments for your work faster and you will have funds to cover current costs or investments. This tax change for ZPP will let many small businesses breathe a sigh of relief. Payment overdue? Send a reminder from eFaktura system

What does a large company in the Netherlands mean?

A large company is one that meets at least two of the following criteria:

- employs more than 250 employees,

- the company’s balance sheet total is greater than EUR 20 million,

- the annual net turnover is at least 40 million Euro.

3. Protection of your KvK address.

The Dutch Chamber of Commerce will allow you to secure your company’s address in the event of a threat to you or your employees. Until now, the company’s address can be downloaded by anyone directly from the KvK register (Dutch Chamber of Commerce).

Protection of your company address is possible in two situations:

- In the event of a specific threat – this protection also applies to a company address that is not the place of residence.

- In the case of certain professions, when, due to their specificity, the openness of the address may pose a threat to you or your relatives.

The date of entry into force of these legal changes is not yet final.

4. Do you want to establish a B.V. company? Do it online!

Until now, it was necessary to visit a notary to set up a company in the Netherlands. There, the notarial deed is signed by all partners.

Thanks to new rule such a visit will not be needed soon. The conclusion of the company can take place by means of a digital notarial deed, so the entire operation can be carried out online.

As a result, from now on, together with your partner (s), you will be able to set up a company by means of a digital notarial deed, so the entire operation can be carried out online. This change is announced on August 1, 2022.

5. Changes in the employment of employees.

The labour market in the Netherlands is becoming even more friendly and attractive, thanks to new changes. Are you hiring employees? Find out what obligations you need to fulfil.

The Dutch government places an obligation on employers to ensure more transparent employment rules. This applies to the obligation to inform, in writing, about:

- the duration and conditions of the trial period

- rules on holidays and non-working days

- the place where the work is performed

- opportunities to raise competences, training

- components of remuneration

- formalities after a possible termination of the employment relationship

The employer finances the training

In some industries, you may be required by law or by the Collective Labour Agreement to provide and finance employee training, which may take place during working hours.

An employee may have more than one employer

An employer cannot prevent his employee from working elsewhere. This does not apply to situations related to the protection of confidential company information or a conflict of interest.

Permanent contracts

Full-time employees, longer than 26 weeks, may apply to work under more predictable conditions (permanent contract). An employee can apply for it once a year. The employer is obliged to respond to such a request within 1 month. In the case of small employers (with less than 10 employees), the time for an response is 3 months.</span?

6. Do you have a construction company? Prepare yourself for a lot of responsibility.

From the beginning of next year, the government will require construction companies to employ a certified and independent quality controller to protect private and business consumers from the risk of hidden defects. The rule regarding liability for these defects will also change – it will be borne by the contractor, even after the building acceptance.

7. Changes in the rules for maternity leave.

On August 2, the Law on Paid Parental Leave (WBO) comes into force. Parents will be entitled to 26 weeks of parental leave, of which the first 9 weeks will be paid. From now the allowance for paid parental leave will be 70% of their daily salary.

The employee must use the paid part of the leave in the first year of the child’s life. The remaining 17 weeks can be used until the child’s 8th birthday. However the last part of the leave is free, unless otherwise agreed in a collective labour agreement or otherwise.

Summarizing the tax changes for ZZP, the Dutch government clearly defines the direction of its policy towards the consumer and cares even more than before for the employee market.

Meanwhile some of the tax changes are aimed at mitigating the effects of the economic crisis, especially for smaller ZZP. Definitely many branches of the economy still need hands to work. Therefore there are no signs that the Dutch labor market will lose its attractiveness in the near future.

Source: https://www.kvk.nl/