Changes in regulations from January 1, 2024, in the Netherlands.

The New Year, as usual, brings changes in tax regulations and legal norms, affecting various aspects of citizens’ lives. What are these changes and what do they mean for the average taxpayer?

Increase in Mileage Rate

A significant tax change this year is the increase in tax-free allowance for business travel using private cars, bicycles, or public transportation. The rate goes up from 0.21 EUR to 0.23 EUR per kilometer. This means you can deduct a higher amount for mileage, which will lower your income tax. To maximize this change, remember to systematically record your kilometers.

Read more about taxes related to car ownership in the Netherlands HERE.

End of Tax Relief for Lump-Sum Income Tax Payments

Do you like to have everything paid upfront and settle your income tax this way? Until now, the Belastingdienst rewarded taxpayers who paid their income tax for the entire year in the first term with additional relief. From January 2024, this relief has been abolished, so for the tax authorities, it doesn’t matter whether you choose annual or monthly tax settlement.

Increase in Minimum Wage

The Dutch government has again raised the minimum wage – currently, the lowest rate is 13.27 EUR per hour, which means an increase of 3.75%.

From this year, the minimum monthly wage is no longer in effect, and the hourly rate is always the basis. This eliminates wage inequality. Previously, full-time employees working maximum hours (40 hours per week) earned less than workers in sectors where the weekly working hours are fewer (36 hours per week).

Changes in the Second Box Tax Rate

Tax rates depend, among other things, on the source of income. Different rates apply for each source (called boxes in the Dutch tax system). From this year, for the second box, i.e., income from limited liability company and joint-stock company, two new rates apply:

- Incomes up to 67,000 EUR – 24.5% rate.

- Incomes exceeding this amount – 33% rate.

For tax partners, this applies to income exceeding 134,000 EUR.

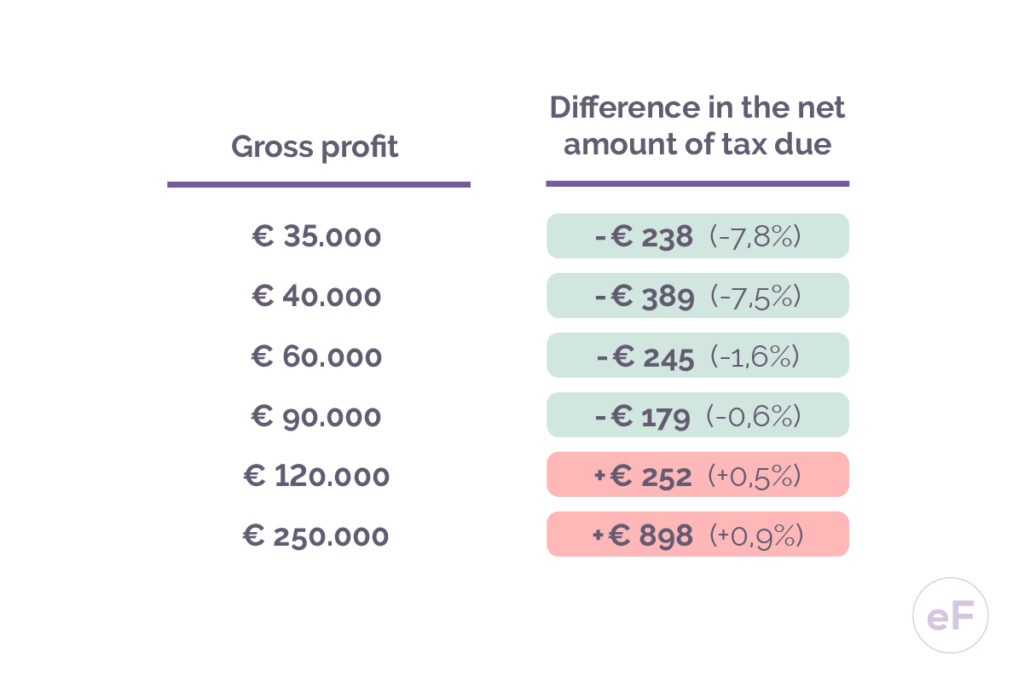

Tax Changes for Self-Employed (ZZP)

The government has introduced a change in tax rates for the self-employed. From now on, ZZPs earning below 90,000 EUR gross can expect lower income tax. In contrast, those earning more (above 90,000 EUR) will pay higher taxes than last year.

Higher Wealth Tax

Have you managed to save up some money? You have to share it! Since January, the tax on profits from savings, stocks, and other assets has increased from 32% to 36%.

The increase also applies to lottery, casino, and slot machine winnings. The so-called gambling tax rises from 29.5% to 30.5% and applies to winnings above 450 EUR.

Have significant savings? Check how much you can keep in your sock HERE.

Valuation of Donations

Donations can be deducted from tax, but from now on, those of high value must be solidly verified. From January 1, 2024, material donations exceeding 10,000 EUR in a year will require independent valuation. This can be done by an appraiser, or it suffices if you present the purchase invoice of the donated items.

Bad Landlords Under Supervision

If you rent out an apartment and your landlord demands more than the market rent rate, you can file a complaint.

From January, in every municipality, there is a point accepting complaints about landlords with dishonest rent rates and too high deposits. You can also report a tenant who is intimidating, discriminating, and not fulfilling the arrangements between you.

In the event of a complaint, the municipality has the task to clarify the situation and oblige the bad landlord to follow the rules.

Tax Relief for Parents with Alternating Care

A novelty is the introduction of tax relief for parents who raise their children separately, equally sharing the care. As a parent, you qualify for the relief if you meet the conditions for equal division of child care and other relief criteria.

Do you run a business and expect a child? See what a ZZP parent can count on HERE.

Changes in Consumption-Related Taxes

The Dutch government hopes that the introduced changes will influence shopping habits and encourage citizens to take better care of their health. The principle is simple – what’s healthy gets cheaper, for what harms you, you’ll pay more.

From this year, the tax on non-alcoholic beverages and juices rises. However, the rate for dairy products, including plant-based and water, is reduced.

Excise duty on alcohol has increased by 8.4%, so for a 5% beer crate, you will pay on average 0.50 EUR more, and for a bottle of wine 0.13 EUR.

Additionally, from April 1, you can expect a significant increase in tobacco product prices: the average price of a pack of cigarettes will be 11.10 EUR (currently 9 EUR), while a pack of tobacco will cost on average as much as 24.62 EUR (currently 17 EUR).

The sale of flavored electronic cigarettes is also banned, with only tobacco flavor available. The government explains this change by the worrying popularity of flavored e-tobacco products among youth.

Fines Going Up Again

Last year’s increases seemed significant, but that’s not the end. This year, the government has once again announced a series of increases in fines. For example, running a red light will now cost you 300 EUR, 20 EUR more. In contrast, a cyclist talking on the phone while riding will pay a fine of 160 EUR, 10 EUR more.

sources:

www.kvk.nl

www.belastingdienst.nl

nos.nl